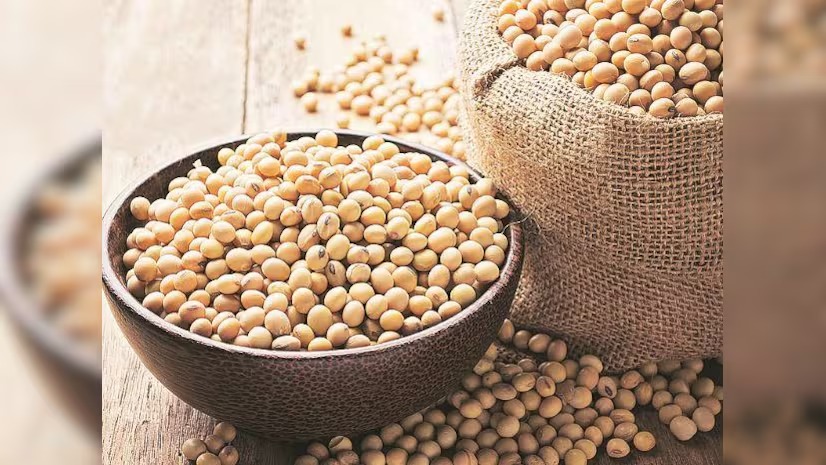

It is imperative for policymakers to consider the nutritional value, cultural significance, and economic impact of such taxation

In the diverse landscape of Indian cuisine, ghee holds a revered position, not just as a culinary staple but as a symbol of tradition and wellness. However, the current taxation framework under the Goods and Services Tax (GST) regime has placed ghee at a disadvantage, imposing a higher tax rate compared to various refined vegetable oils. This disparity raises questions about the alignment of tax policies with nutritional and cultural values.

Ghee, a form of clarified butter, is rich in fat-soluble vitamins A, D, E, and K, and contains butyric acid, known for its anti-inflammatory properties. Its high smoke point makes it suitable for cooking, and it’s free from trans fats commonly found in some refined oils. In contrast, many refined oils undergo extensive processing, which can strip them of natural nutrients and introduce additives.