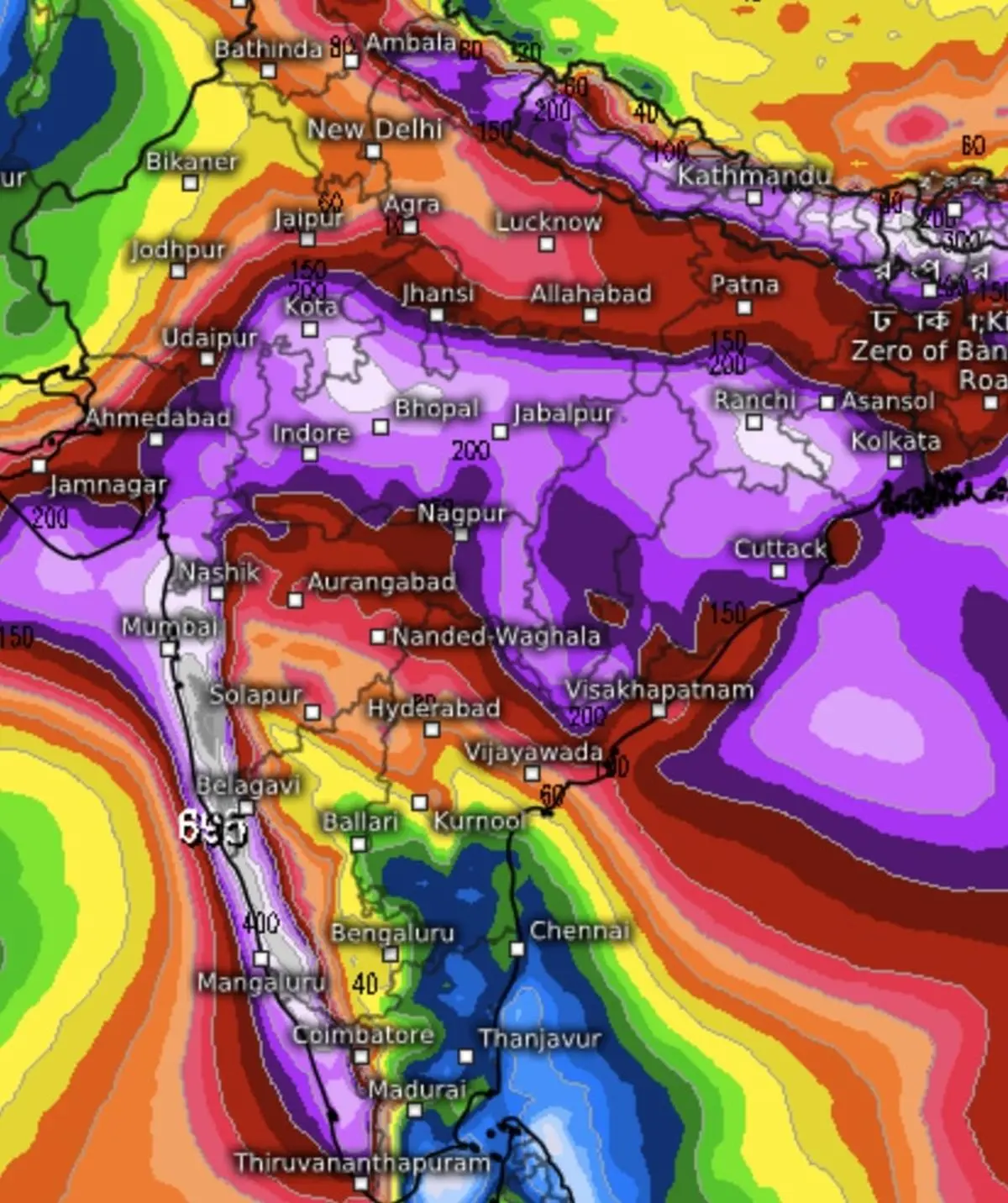

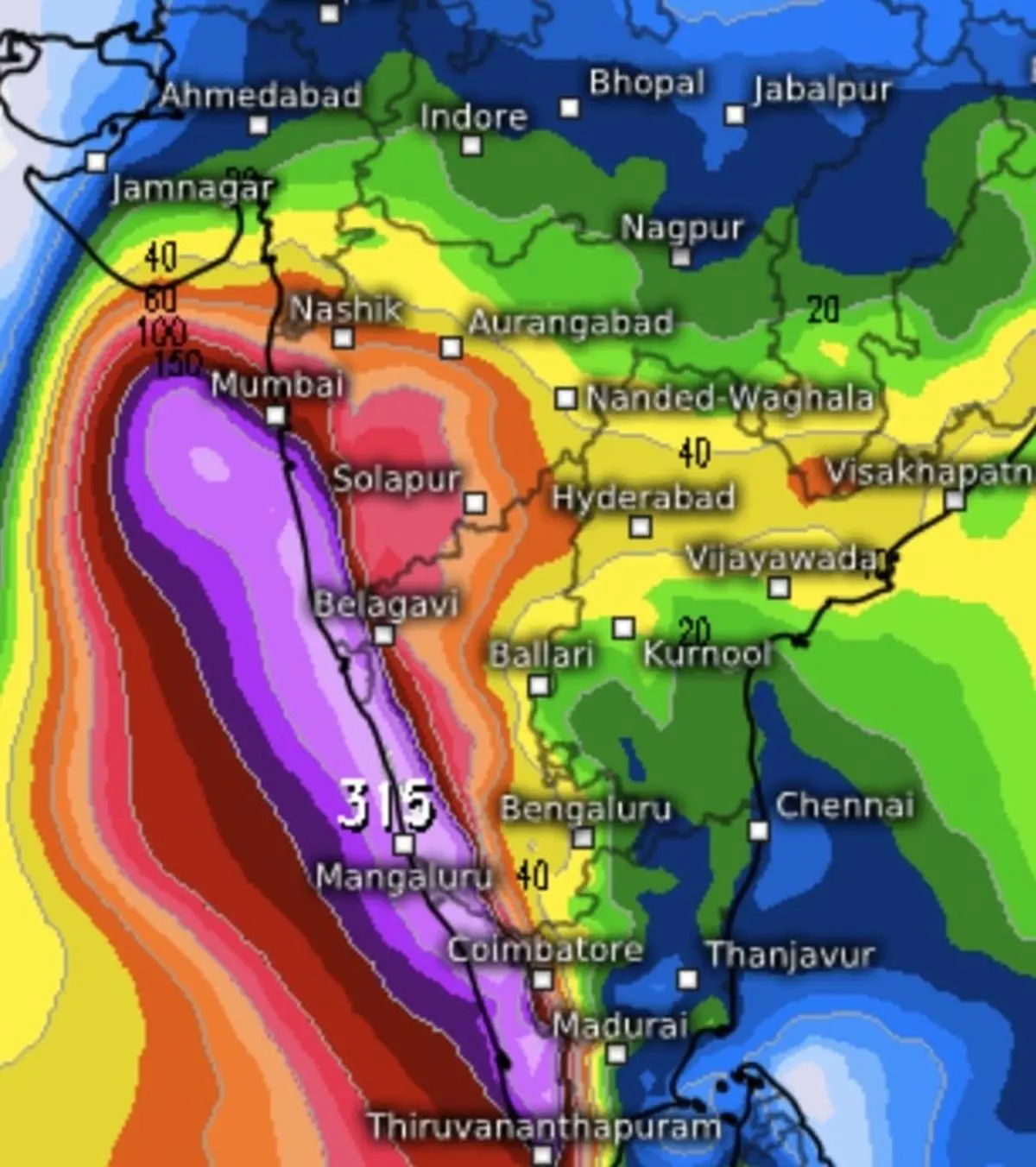

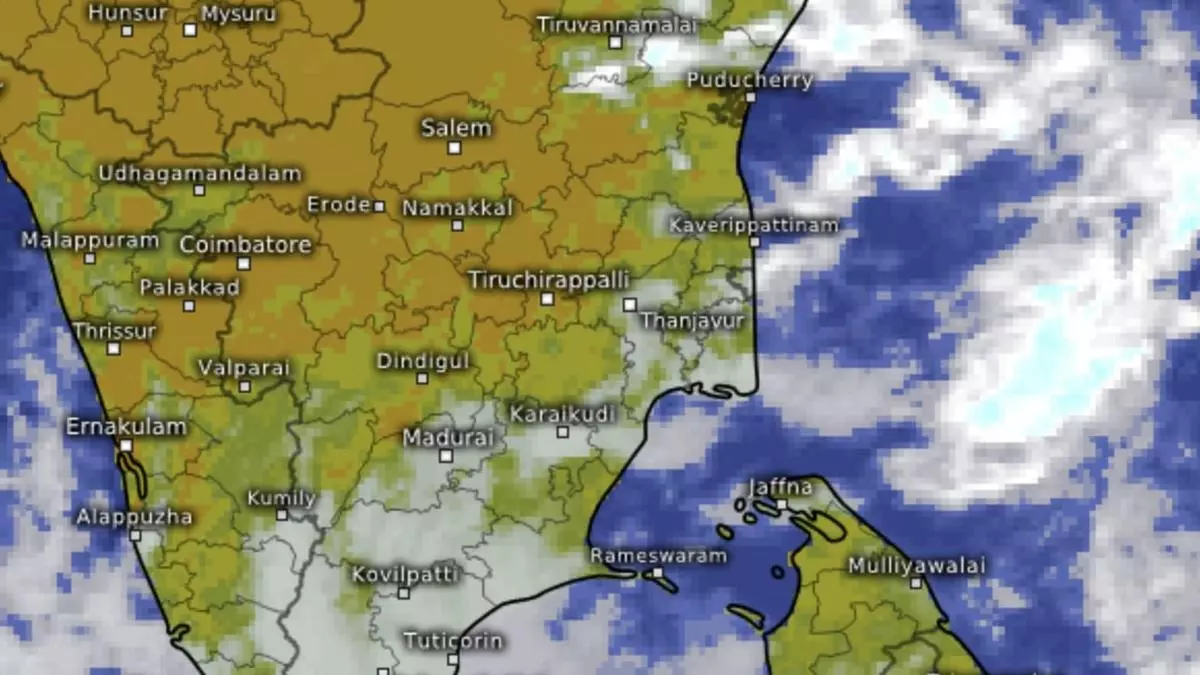

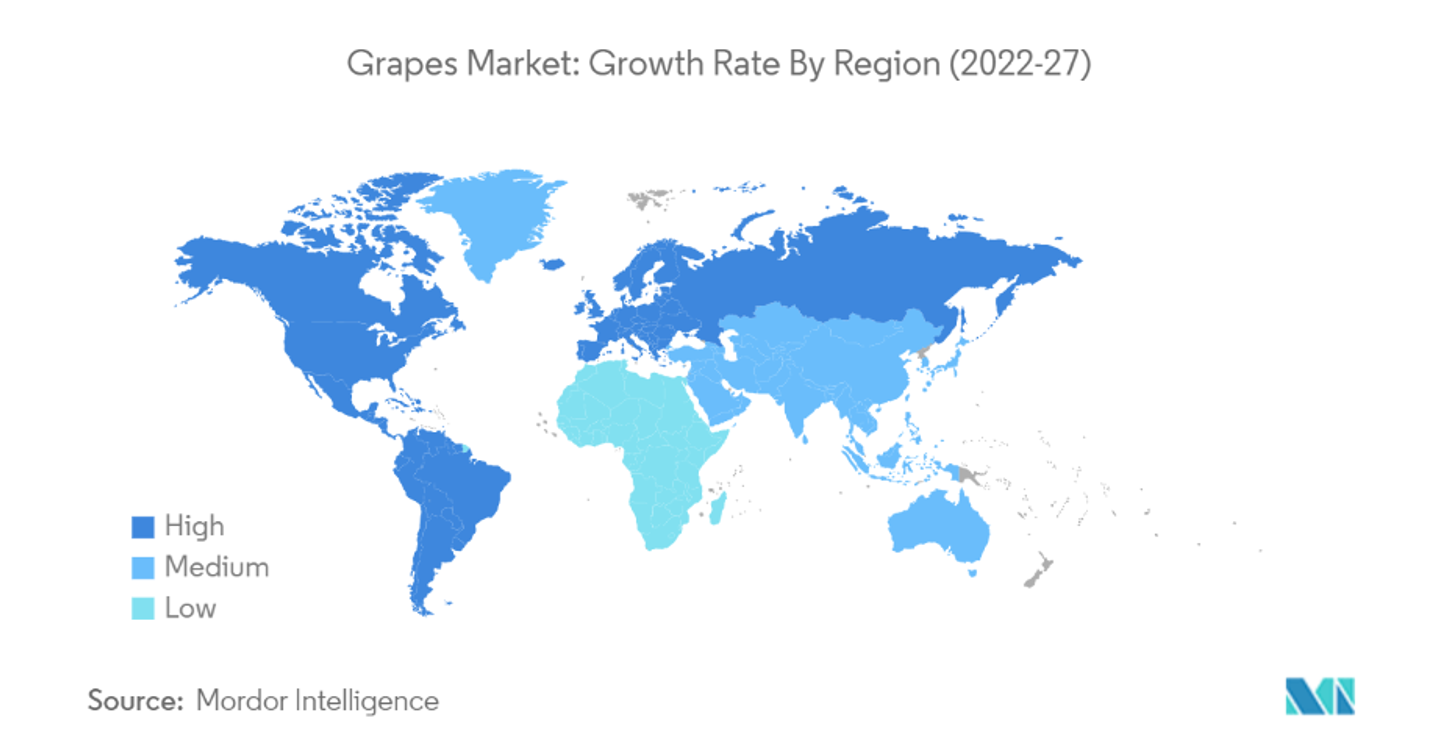

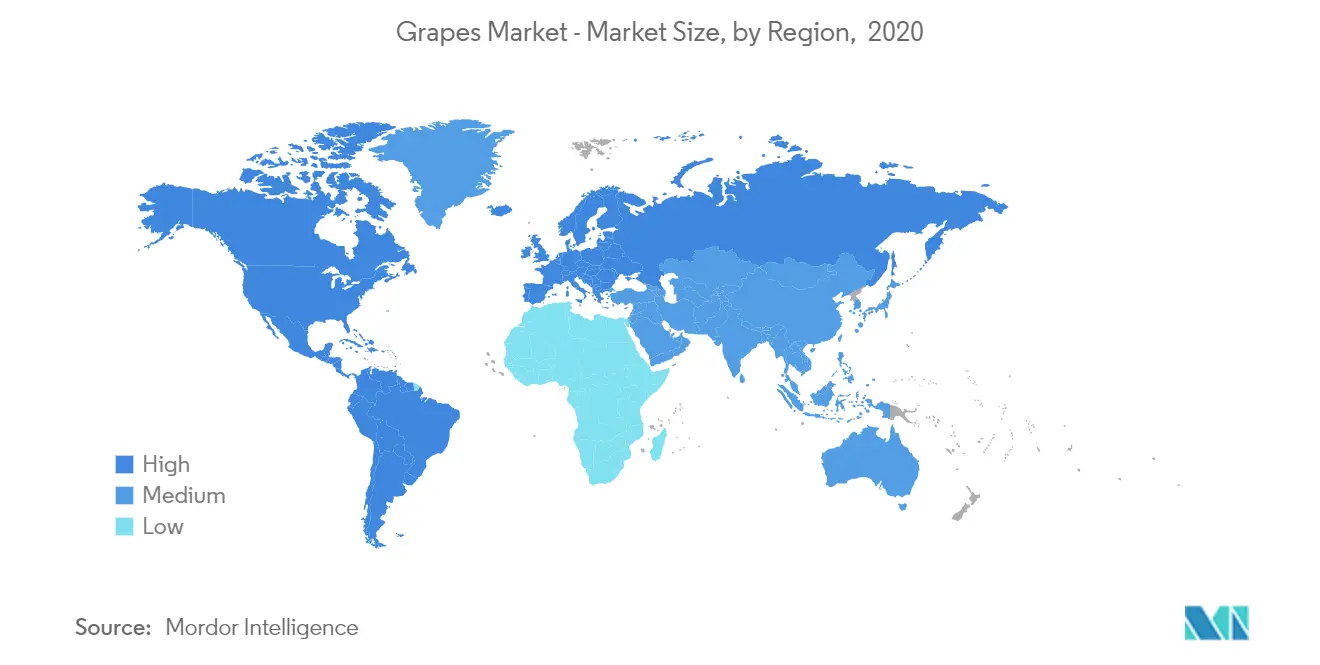

As India approaches the rabi season, the recent halt in speciality fertiliser exports by China presents both challenges and significant opportunities for domestic Indian fertiliser producers. While China has been restricting supplies of specialty fertilisers to India for the past 4-5 years, a complete halt impacts 80 per cent of specialty fertilisers supply for high-value crops such as fruits and vegetables, affecting agricultural belts in Maharashtra, Gujarat, Tamil Nadu, Uttar Pradesh and West Bengal.

An estimated 130,000-140,000 tonnes of speciality fertilisers were imported from China between June and December 2024 alone. Notable products include controlled-release fertilisers (CRFs) such as polymer-coated urea (PCU), chelated micronutrients (Fe-EDTA, Zn-EDTA, Fe-EDDHA), water-soluble fertilisers (WSFs) such as monoammonium phosphate (MAP) and potassium nitrate (KNO₃); and stabilised nitrogen fertilisers with urease inhibitors (NBPT).

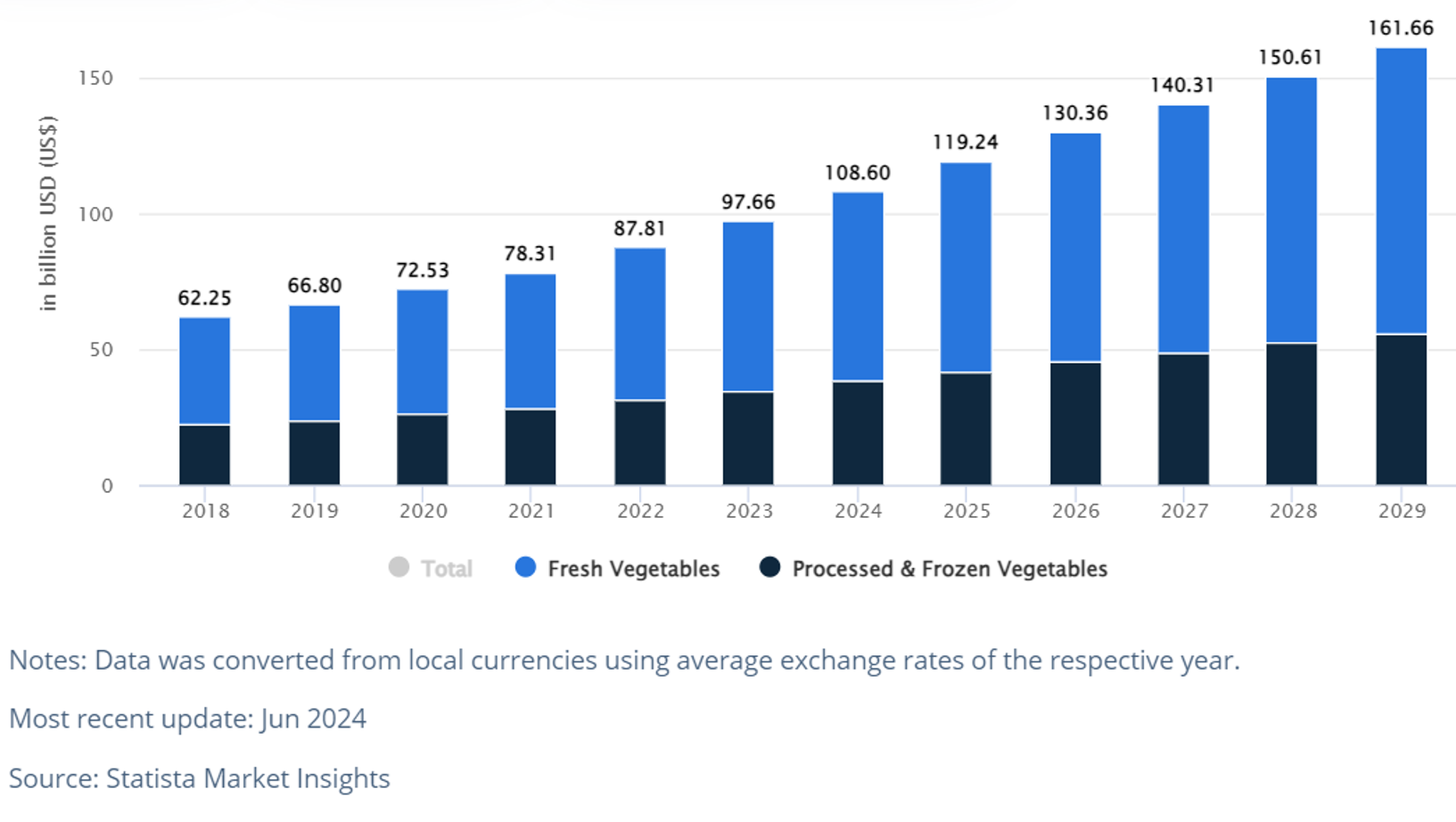

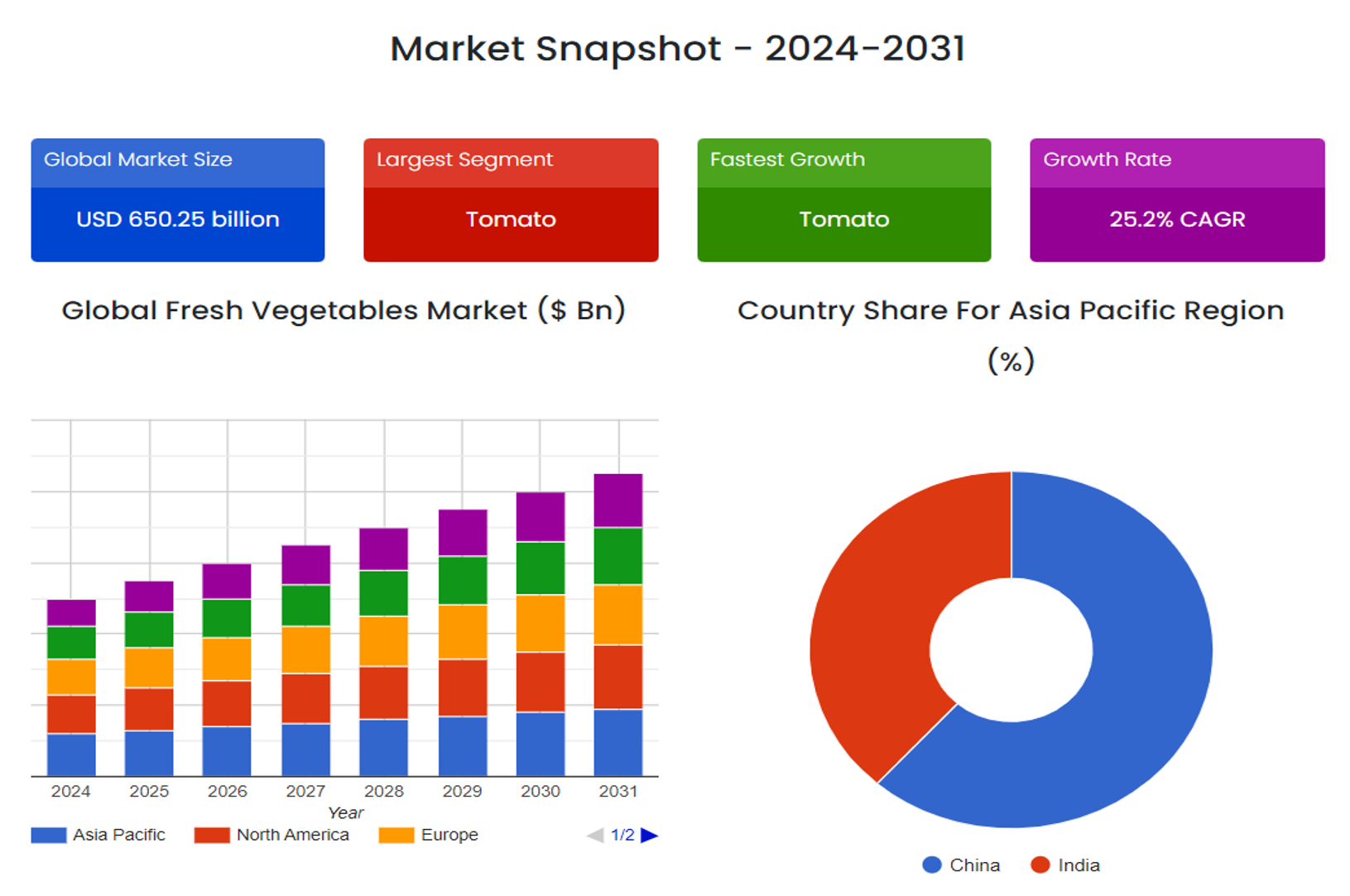

There are fears of price rises, as availability is not expected to be a major challenge. India has alternative import options from Russia, Jordon, and Israel; however, timely shipment arrival remains a concern. The Speciality Fertiliser Market has strong growth potential and is expected to reach $63 billion by 2035 globally, backed by sustainable agricultural practices.