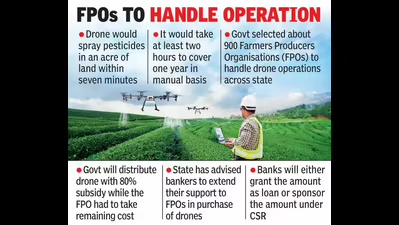

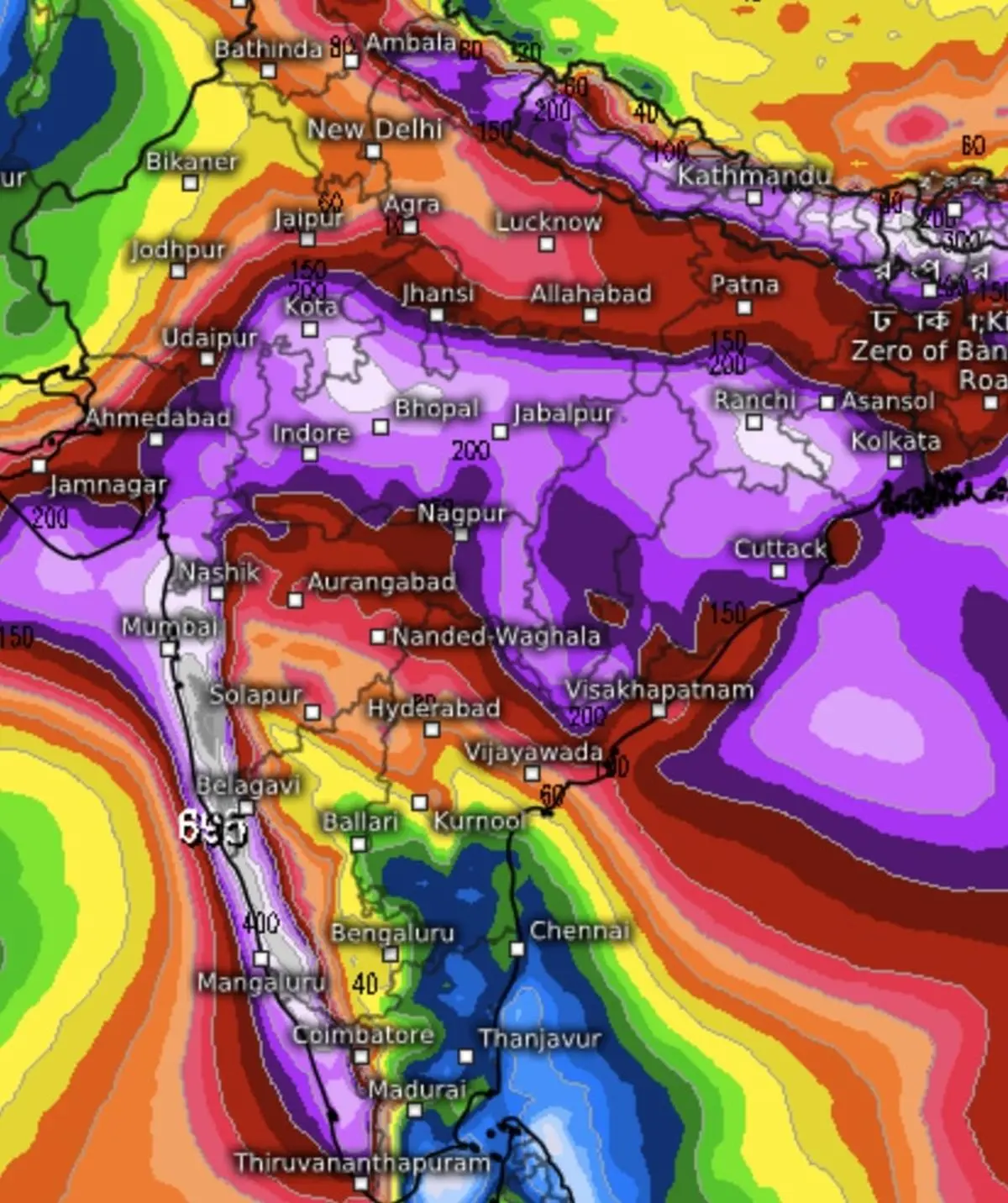

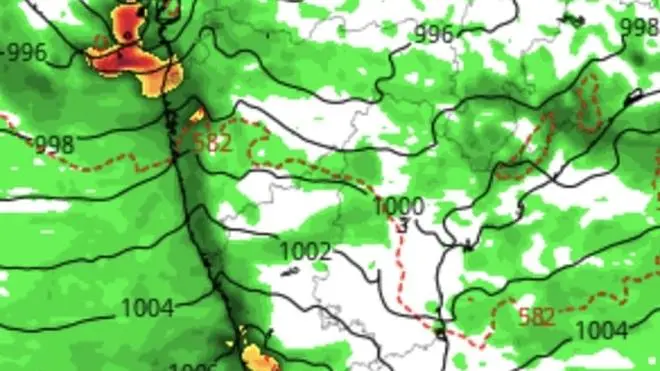

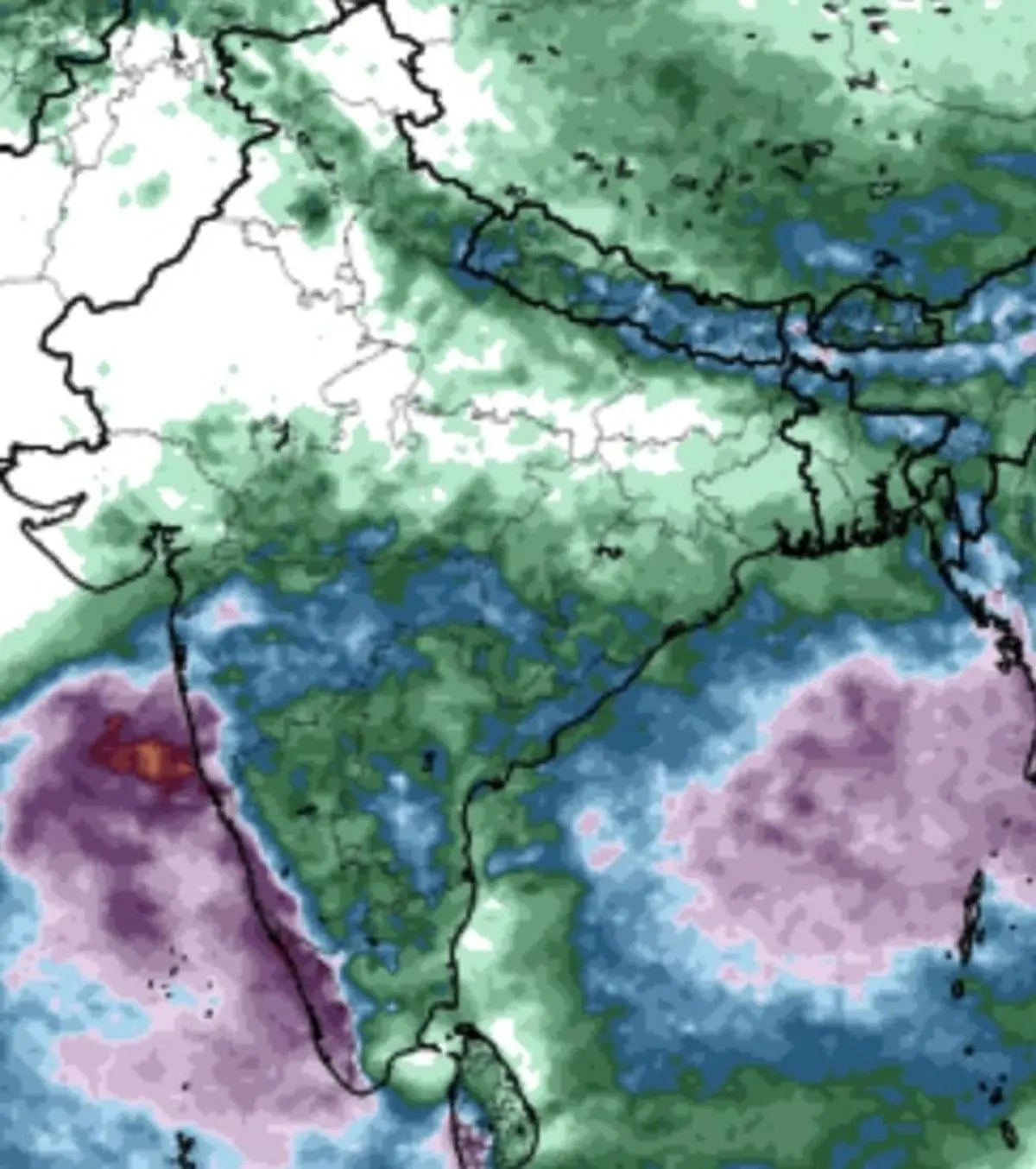

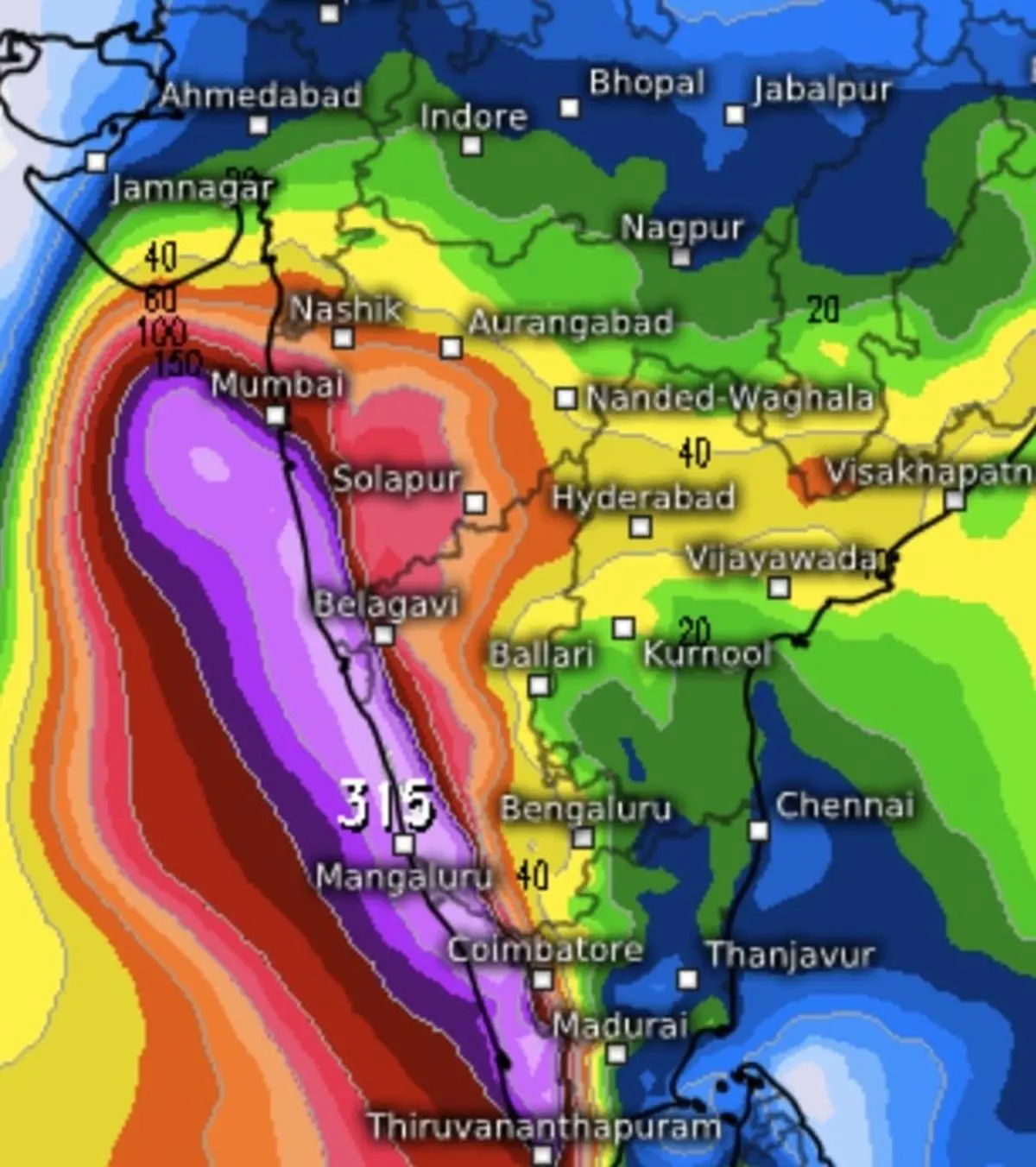

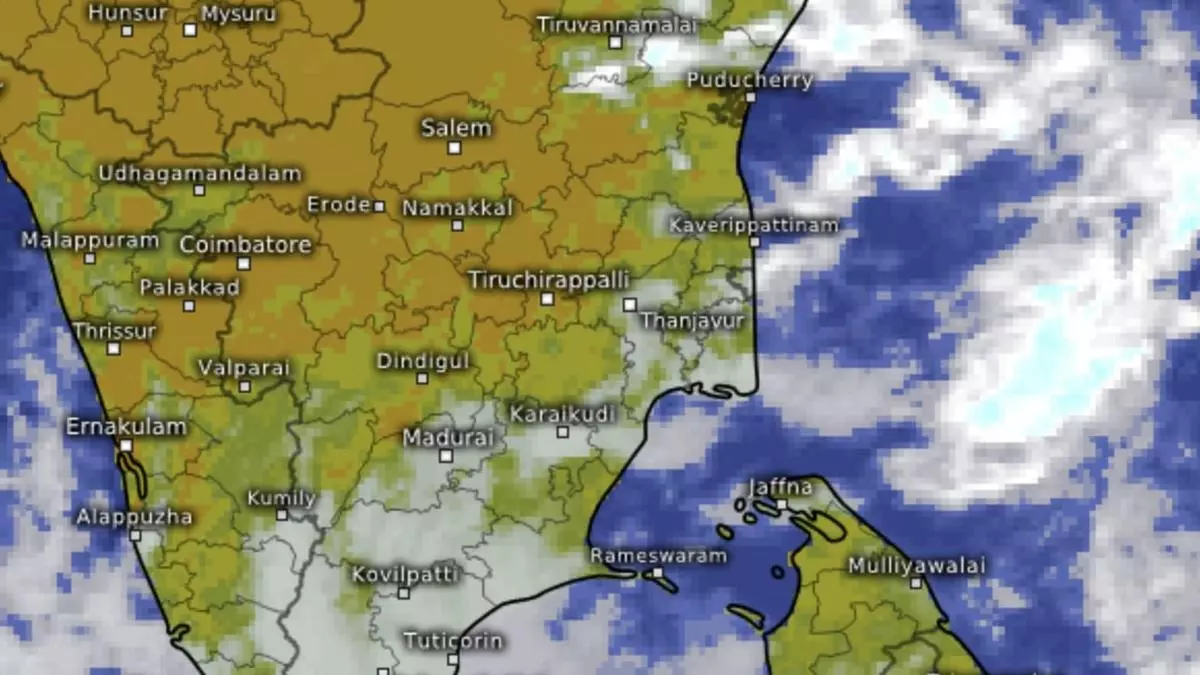

The Reserve Bank of India (RBI) has proposed to include expenses related to technology innovations like soil testing, real-time weather forecasts, and organic/good agricultural practices certification, to be eligible for farm loans. These will be covered within the 20 per cent additional component currently allowed towards repairs and maintenance of farm assets.

It has been proposed that banks should waive collateral security and margin requirements for agricultural loans, including loans for allied activities up to ₹2 lakh per borrower.

The regulator, on Thursday, released revised draft norms on Kisan Credit Card scheme with an aim to expand coverage, streamline operational aspects and address emerging requirements in the agriculture sector.

In a move to bring uniformity in loan sanction and repayment schedules, crop seasons have been standardised in terms of months—short-duration crops (12 months) and long-duration crops (18 months).

“To ensure proper dovetailing of loan tenure with crop seasons, especially for the longer duration crops, the tenure of KCC has been extended to 6 years,” the draft norms said.