What impact will lower GST have on farming and allied sectors?

The recent announcement of the GST reform package will have a significant impact on the Indian economy, including the agriculture and allied sectors. Reducing the GST rates on farm machinery and fertiliser inputs—from the current 12 per cent (machinery) and 18 per cent (fertiliser inputs like ammonia, sulphuric and nitric acid) to just 5 per cent and even reducing the GST rates on many food items from 5 per cent to nil or from higher slabs to 5 per cent is expected to give a boost to rural demand and ease off cost pressures on producers, which in turn will have a cascading impact on the economy, especially in rural India.

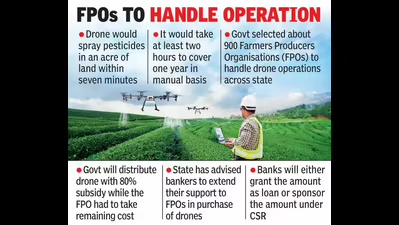

1. Reduced cost of mechanisation: A lower 5 per cent GST on tractors, engines, irrigation nozzles, and similar equipment would significantly reduce the upfront cost and make mechanisation more accessible for small and marginal farmers. To reap the full benefits and make it inclusive for the farming community, especially small and marginal farmers, supply chain inefficiencies (e.g., storage, transport) need to be addressed.

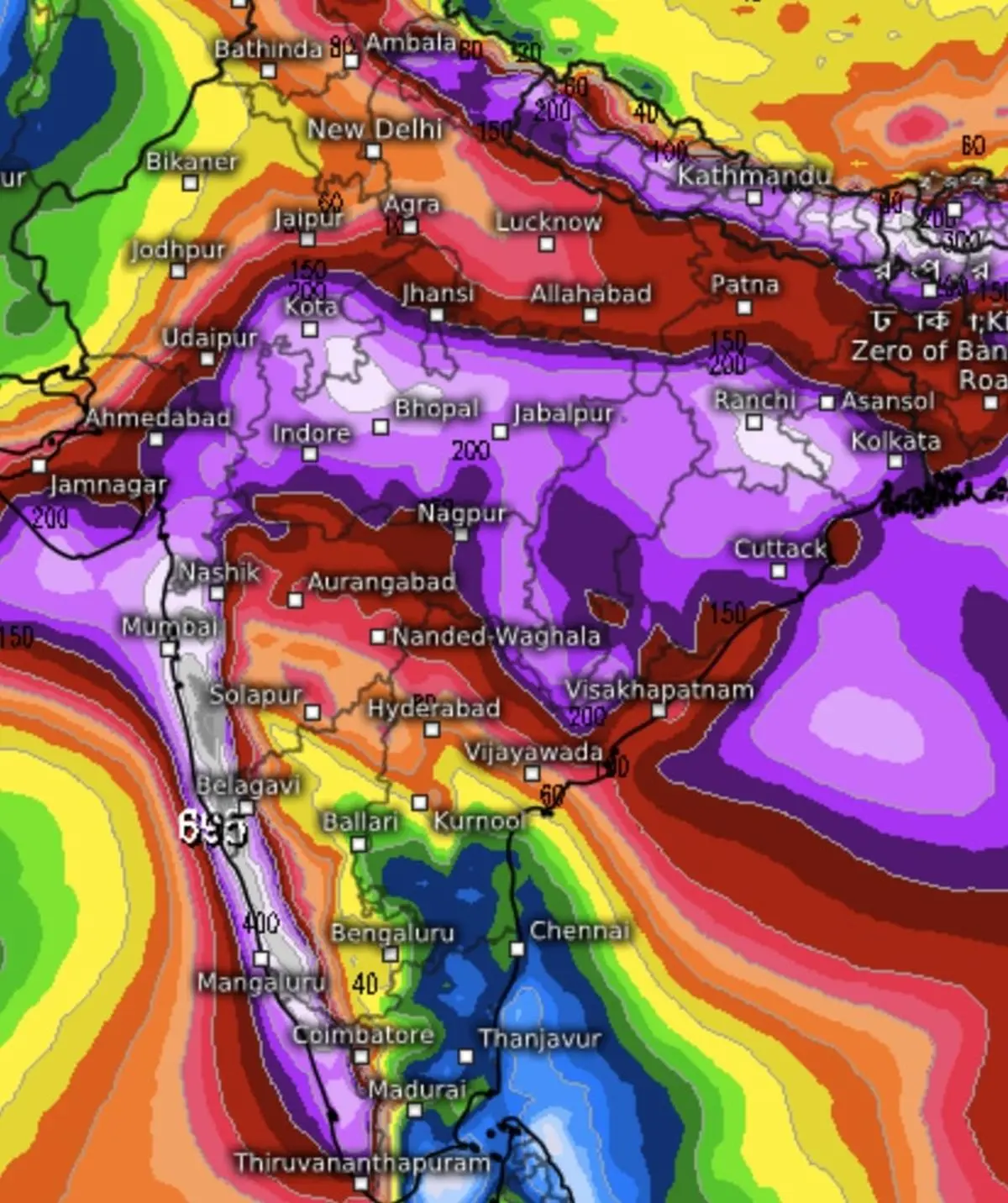

2. Revitalised rural demand: These cuts could potentially reinvigorate rural consumption, mostly through reduced input prices and improved accessibility, thereby providing a much-needed boost in farm economy activity.